Xpeng will open VLA 2.0 test drives across 732 stores in China starting March 11.

Analysts view the technology’s rollout as a key driver for Xpeng’s sales recovery.

Xpeng will open VLA 2.0 test drives across 732 stores in China starting March 11.

Analysts view the technology’s rollout as a key driver for Xpeng’s sales recovery.

Yangwang, the luxury arm of the auto giant BYD, shared the first look at the inside of the 2026 Yangwang U8. This SUV is a true powerhouse that mixes off-road toughness with the kind of comfort you usually find in a private jet. It is designed to take on the likes of the Mercedes-Benz G-Class and the Range Rover by… Read more…

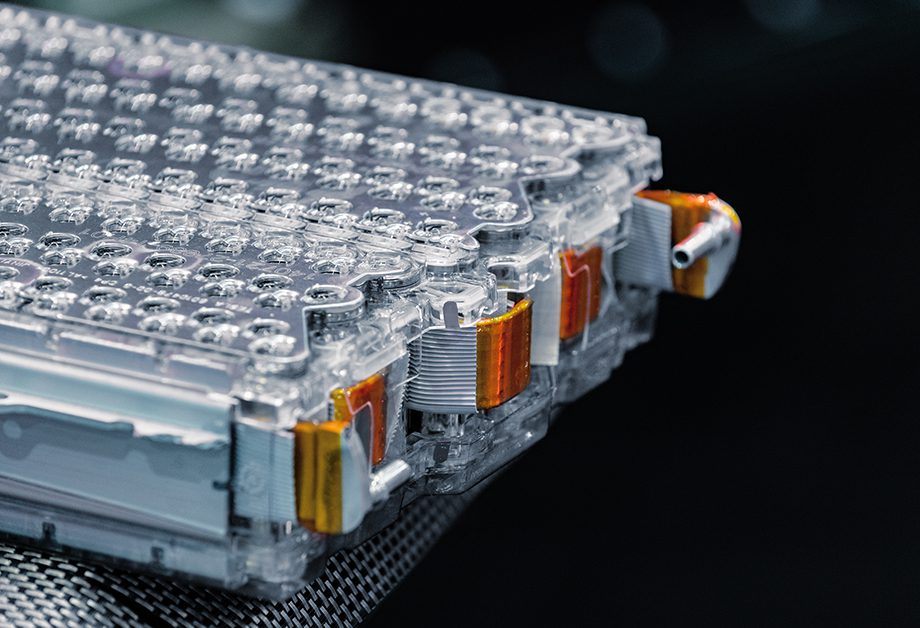

CamMotive has opened a new battery testing lab in Cambridge, UK, with more than 800 high-current cell-cycling channels and the ability to deliver up to 800 A per cell. The company says the facility is aimed at speeding development and validation of next-generation batteries for automotive and other high-power applications. According to CamMotive, the lab… Read more…

Sponsored by Avery Dennison Performance Tapes. Tapes can simplify complex processes, support robotic assembly, reduce scrap, and more. By Max VanRaaphorst Globally, more than 60 million EVs are now on the road. It’s a number that might have seemed unimaginable just a few years ago. It underscores how EV OEMs have moved beyond needing only… Read more…

Back in early February, a rumor claimed Porsche would be axing the electric Cayman and Boxster projects under the leadership of newly appointed CEO Michael Leiters, or at least reconsidering their viability. Now, Porsche Cars Australia Managing Director and CEO Daniel Schmollinger begs to differ. He says the project is very much still alive, and he’s even driven the electric… Read more…

The Kia EV4 is available as a hatchback and fastback, both of which are due for a GT upgrade. Which one would you choose. Read more…

The Kia EV4 is available as a hatchback and fastback, both of which are due for a GT upgrade. Which one would you choose. Read more…

The Chevy Equinox EV is “America’s most affordable 315+ mile range EV” for a reason, right? For the 2026 model year, buyers will have one less exterior color option to choose from. Read more…

The Chevy Equinox EV is “America’s most affordable 315+ mile range EV” for a reason, right? For the 2026 model year, buyers will have one less exterior color option to choose from. Read more…

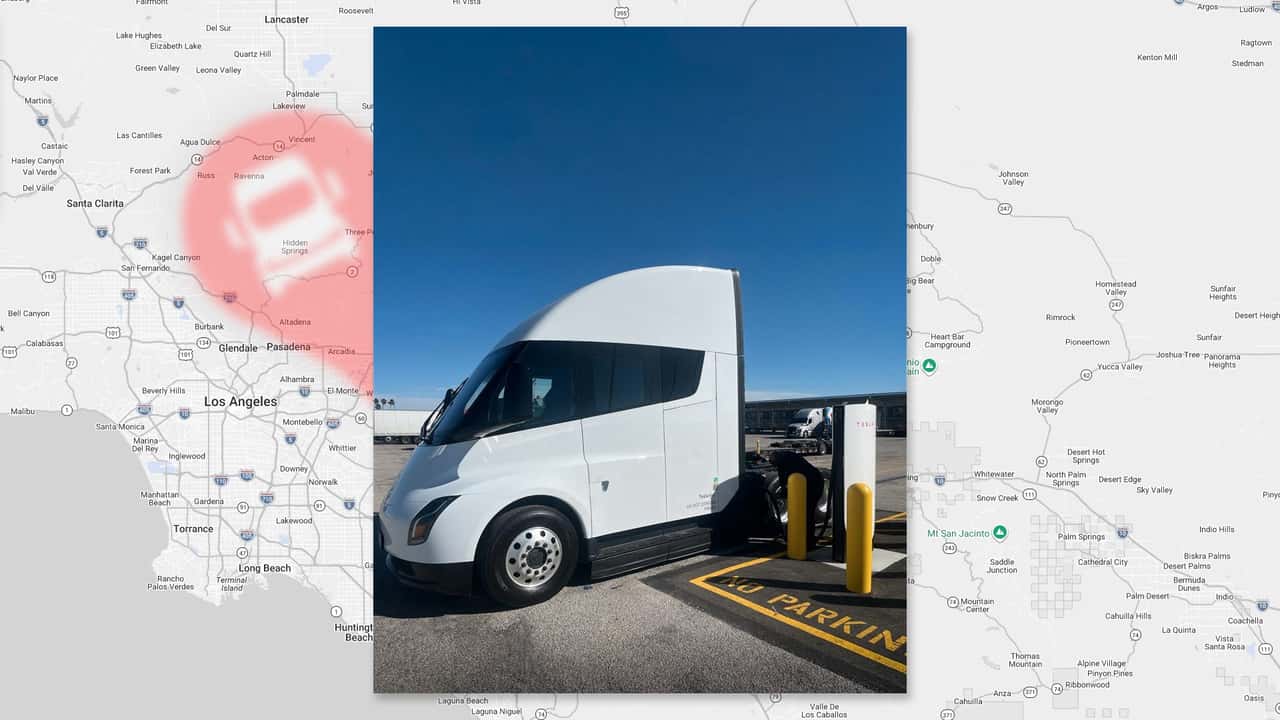

Tesla’s new Megacharger is near Los Angeles and is open to Semi customers. Lire la suite…

Wieland Electric will showcase its new podis power bus system for EV infrastructure at the upcoming EV Charging Summit and Expo 2026 in Las Vegas. Wieland’s podis is designed to simplify, accelerate and future-proof EV charging installations. The podis decentralized power distribution system offers a modular, plug-and-play alternative to traditional hard-wired installations. It’s aimed at… Read more…

Cary, North Carolina has deployed a Pierce Volterra plug-in hybrid fire truck. The city adopted its first light-duty electrified vehicles a decade ago, and chose to electrify this heavy-duty truck in order to improve public health and air quality, firefighter working conditions, and long-term fleet resilience. The Pierce Volterra features an Oshkosh parallel-hybrid drivetrain. Both… Read more…

The Vision V concept is finally turning into reality. Mercedes is ready to introduce the all-electric VLE, the successor to the Vito and V-Class. The VLE uses the VAN.EA platform and is a flexible vehicle for families and “leisure active customers”, as well as VIP shuttles. Its official unveiling is taking place tomorrow, March 10, at 7 PM CET, which… Read more…

A covered Genesis GV90 appears to be charging at a Tesla Supercharger ahead of its expected debut later this year. Read more…

A covered Genesis GV90 appears to be charging at a Tesla Supercharger ahead of its expected debut later this year. Read more…

Thomas Dmytryk, the director who led the team that built Tesla’s over-the-air update infrastructure and the software backbone of its Robotaxi ride-hailing service, has announced his departure after 11 years at the automaker. Read more…

Thomas Dmytryk, the director who led the team that built Tesla’s over-the-air update infrastructure and the software backbone of its Robotaxi ride-hailing service, has announced his departure after 11 years at the automaker. Read more…

BYD’s Flash Chargers can charge an electric vehicle just as fast as filling up at a gas station, but it’s not the only automaker with ultra-fast 1,500 kW EV chargers. Read more…

BYD’s Flash Chargers can charge an electric vehicle just as fast as filling up at a gas station, but it’s not the only automaker with ultra-fast 1,500 kW EV chargers. Read more…

Slate’s new top executive, Peter Faricy, will be tasked with bringing its mid-$20,000s pickup truck to market. Lire la suite…

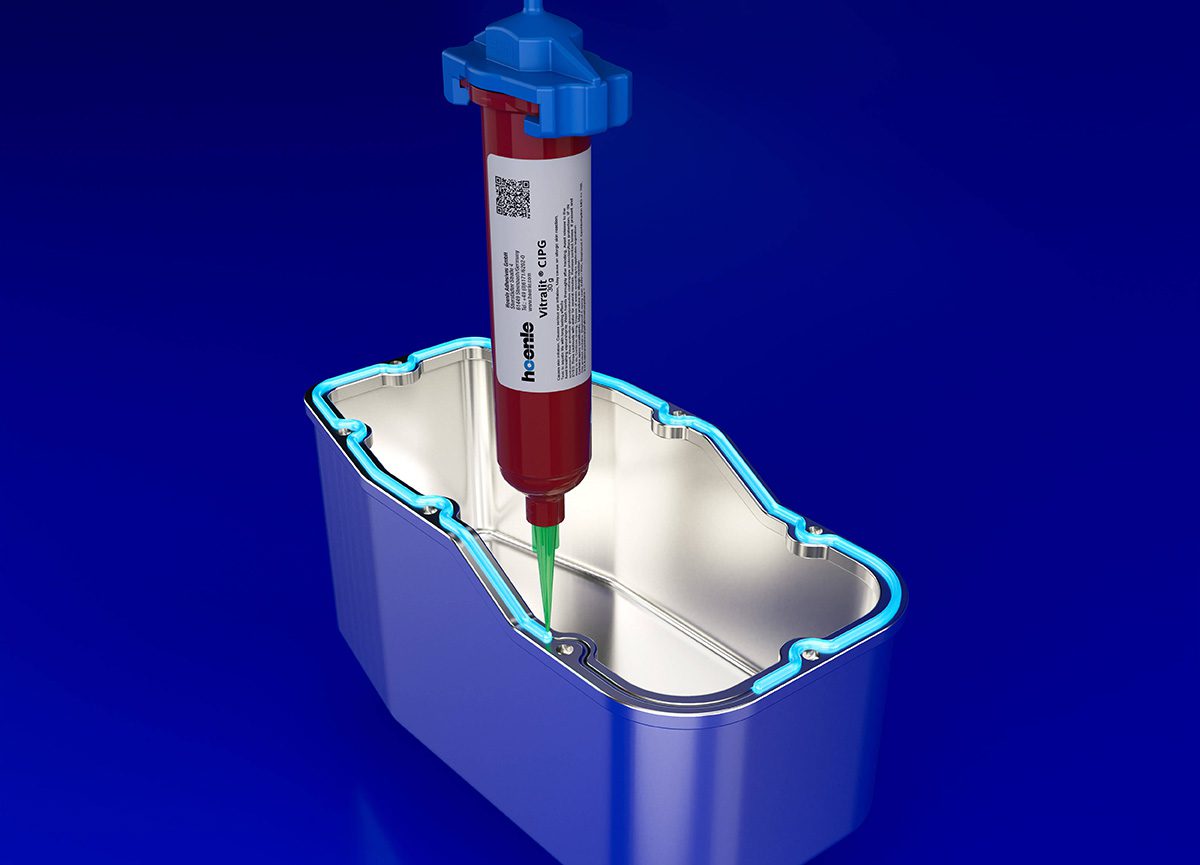

Hoenle Adhesives has introduced Vitralit CIPG 60200, a UV-curable cured-in-place gasket material for automotive and e-mobility electronics housings. The company is positioning the blue fluorescent polyacrylate as an alternative to conventional solid gaskets and FIPG silicone systems for complex 3D sealing geometries. Hoenle says the material can be dispensed precisely with adhesive valves and programmable… Read more…

Aptera Motors (NASDAQ: SEV) was originally founded in 2006. However, while other EV startups from that area endeavored (and mostly failed) to follow a three-step iteration from a low-volume luxury vehicle to an affordable mass-market EV, Aptera took an entirely different approach. The goal was simply to build the most efficient EV possible with available… Read more…

Geely will unveil the Galaxy M7 mid-size plug-in hybrid SUV on March 13 to help regain the sub-brand’s strong sales momentum.

The first production M7 officially rolled off the assembly line on March 5, marking Geely Galaxy’s 2-millionth vehicle production milestone.

Qijing has officially named its first shooting brake coupe GT7, highlighting the model’s driving control and intelligent experience.

The GT7 is equipped with Huawei’s highest-specification 896-channel LiDAR technology, aiming to capture a share of China’s growing premium EV market.

The upgraded GXR robotaxi is scheduled to officially roll off the production line in the third quarter of 2026.

Leveraging Geely Farizon’s manufacturing system, the production time for a single vehicle to roll off the line will be drastically reduced from 1 hour to under 10 minutes.

Evearly news aggregates news about electric vehicles (cars, motorbikes, scooters, trucks) from various sources.

Evearly news brings together electric vehicle news from many sources to offer 63545 articles for consultation. Evearly news offers:

Evearly was initiated by people wishing to see more electric vehicles on the roads.

Contact us: Contact